#Turbotax return calculator how to#

RELATED: How To Use Nanny Tax Calculator 4. It has the benefits of Free and Deluxe editions.

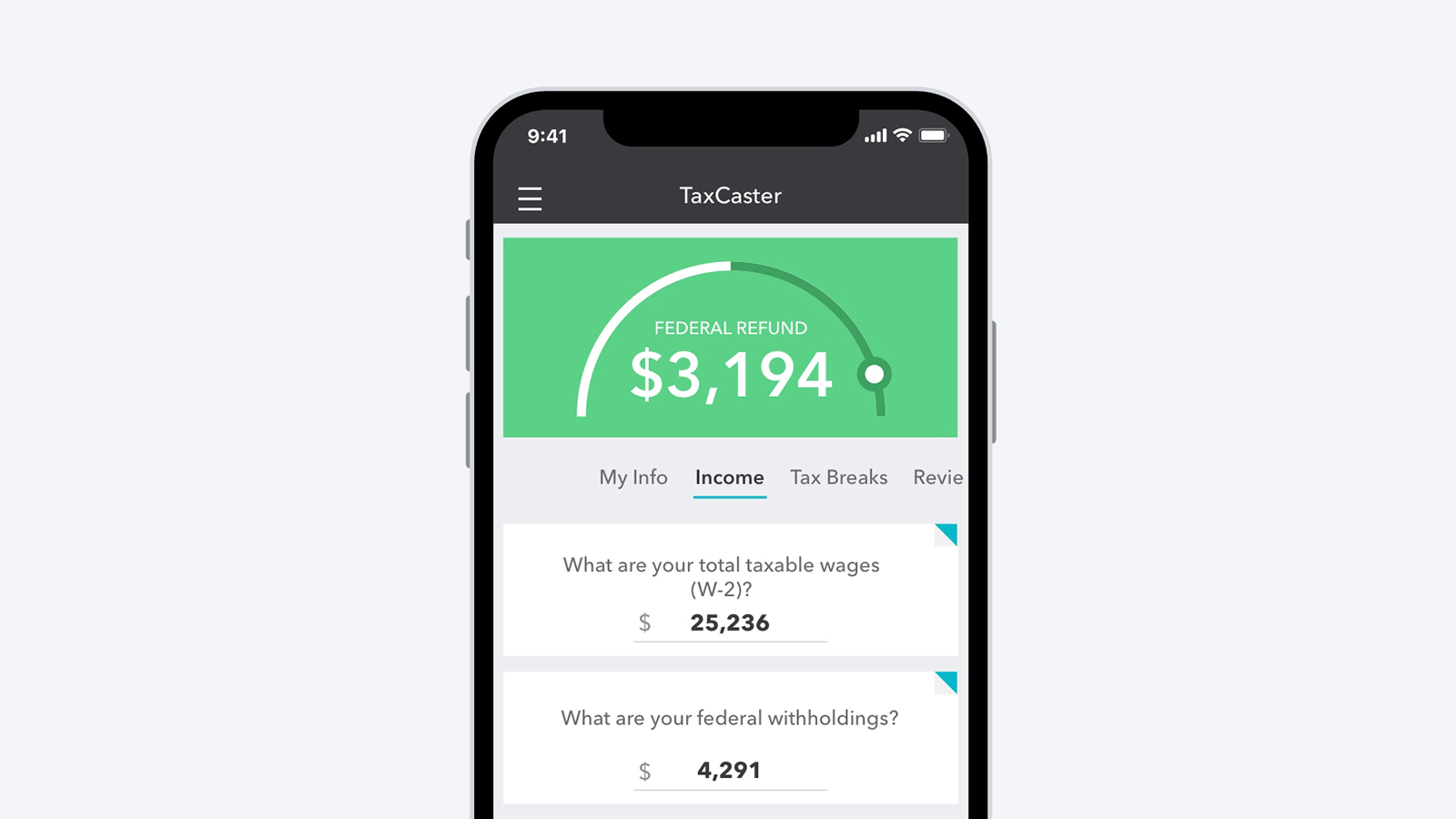

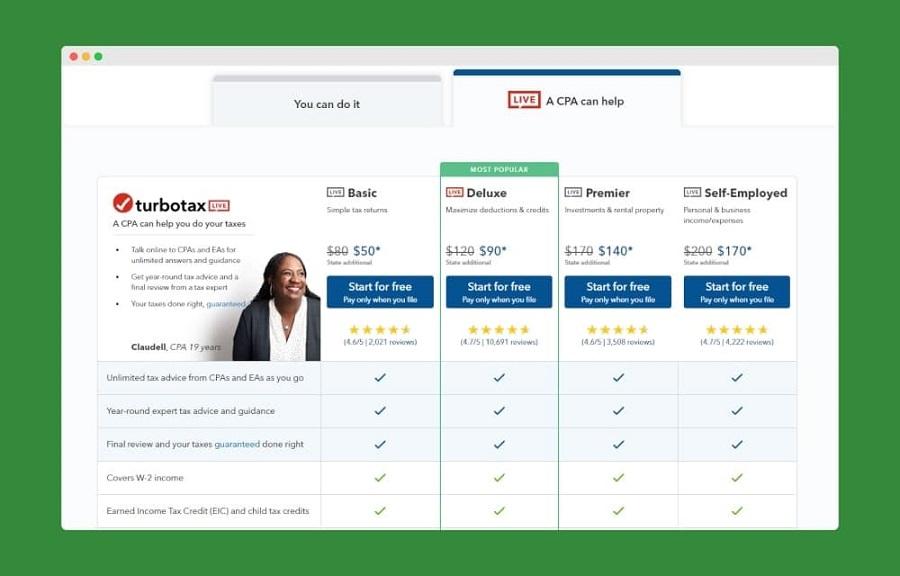

It can also import the necessary financial information to calculate capital gains and loss and cost basis. These include earnings from stocks, bonds, real estate including rental, and cryptocurrency. This is the Turbo Tax Calculator for people with investment income. They also pay for the tax service only when they file the returns. Users can also receive the guidance or support from a tax expert. It can also help convert donations into additional significant deductions. In turn, it helps taxpayers maximize their deduction and refund. It works like the Free version, but the biggest difference is it searches among its 300+ types of deductions and credits. This is the most popular Turbo Tax Calculator. It is not for individuals who need to provide itemized deductions, business income, or rental income, among others. There’s also no cost in actually submitting the tax form. It is free whether the taxpayer is filing a state or federal income tax. People with W-2 income can also take a snapshot of the form and answer a series of questions in relation to tax data. It is also for those filing 1099-NT or 10999-DIV (limited interest and dividend income).

It is applicable for people with child tax credits, earned income tax credit (EIC), and standard deduction claims. It means they submit Form 1040 with no other schedules attached to it. This program is available for taxpayers with a simple tax return. Taxpayers can choose among the different Turbo Tax Calculators: 1.

0 kommentar(er)

0 kommentar(er)